Updated: January 1, 2018 Home » Investment

When To Buy And Sell Stocks ? One of the benefits of investing in the stock market is that you can do it after trading hours. Bursa Malaysia is open from 9am to 12.30pm, then again from 2.30pm to 5pm but you can do research and place orders outside these hours.

Example, let’s say you go to work all day and only have free time during the evenings and weekends. In the evenings you will review what happened to the market that day and decide how to trade the next day. If you miss a few nights during the week, you can do your analysis on the weekend.

Trading Procedures:

1. Open an Account – RM10

- Open a trading account and a Central Depository System (CDS) account with a stockbroking company.

- You will then be engaged with a licensed dealer (paid salary) or a remisier (commission base).

2. Engage Remisier

- Give an order to your remisier to buy or sell a specified number of shares of a company at a specified price.

3. Placing an Order

- Your orders are keyed into the WinSCORE (Bursa Malaysia’s fully automated trading system) terminal at the stockbroking company.

- It is then relayed through the WinSCORE system to Bursa Malaysia’s central computers.

- The order confirmation is immediately routed back to the stockbroking company.

4. Match Order

- Orders are matched automatically by the system.

- All prices which orders are matched are determined by market forces of supply and demand through a process of bids and offers.

- In every transaction, a security is sold to the highest bidder and purchased at the lowest offer.

- The price transacted for a buy order will either be at the same price keyed in, or lower if the seller’s price is below the buyer’s price.

- For a sale transaction, the price will be the same or higher if the buyer’s order is higher.

5. Trade Confirmation

- Once the order is matched, a trade confirmation is printed out, providing details such as the original order number, stock number, price and quantity matched and the counter-party stockbroking company.

- The remisier in turn confirms with his client that he has bought/sold the specified number of shares and the price at which it was bought/sold.

- To facilitate differentiation and to avoid confusion, the stockbroking company has different coloured slips for ‘sell’ and ‘buy’ orders.

6. Contract Notes

- The broker firm will then send out and post the contract notes to you, giving details of the transaction such as brokerage, stamp duty and clearing fees payable as well as the cost of purchase or proceeds of the sale.

7. T + 3

- There is no physical delivery of shares under the CDS. Instead, the CDS uses a simple book entry system to keep track of the movement of shares which arise from trades affected on Bursa Malaysia.

- For example, if you are a buyer of share A, your CDS account will be credited with Share A and the seller’s account will show a debit of Share A.

- Sellers must have adequate shares in their CDS accounts by 12.30 pm on T+2 and buyer’s account will be credited on T+3 with the shares, with T being the transaction date. (Source: klse.com.my)

Transaction Costs

In addition to the cost of the shares bought or sold, the client will have to pay the following charges per contract:

Brokerage Rates

Call over phone: 0.6% (min RM40 , <100k), 0.3% (>100k)

Internet trading: 0.42% (min RM12, <100k), 0.21% (>100k)

Clearing Fees

0.03% of transaction value with a maximum of RM1000.00 per contract. There is no minimum fee imposed.

Stamp Duty (round up)

The stamp duty chargeable on transactions on the stock market of Bursa Malaysia is:

- RM1.00 for RM1000.00 or fractional part of value of securities and effective 17 March 2003, the stamp duty shall be remitted to the maximum of RM200.

- All instruments relating to the issue of, offer for subscription, or purchase of, or invitation to subscribe or purchase, debentures approved by the Securities Commission under Section 32 of the Securities Commission Act, 1993, and the transfer of such debentures, are exempted from stamp duty.

Board Lot or Normal Lot

Shares are normally traded in specific amounts called Board Lots of 100 units. Any amount less than board lots are called special lots or odd lots.

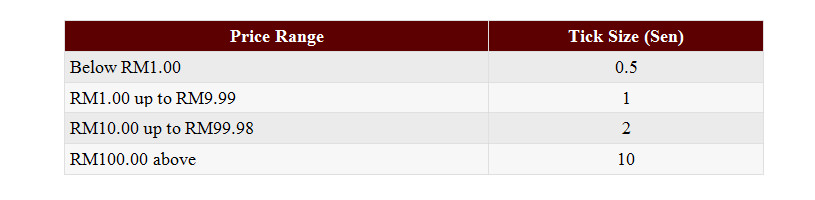

Minimum Bids

Bursa Malaysia’s revised tick size structure was implemented on 3 August 2009.The tick size is the minimum price variation between the buy and sell price for a stock. The tick size is reduced in line with the current practice by global developed markets and more importantly, to create market depth, enable price discovery and boost liquidity in the local equities market.

The tables below describe the new tick size structure.

Trading Sessions

Trading at Bursa Malaysia from Monday to Friday, except on public holidays and other market holidays (when the Exchange is declared closed by the Bursa Malaysia Committee).

Note: Effective 18 April 2011, all unmatched orders during the first session will be automatically carried forward to the second session and shall be considered as valid for the whole trading day.

Discover more from MisterLeaf.com

Subscribe to get the latest posts to your email.