If you want to buy a house or take a home loan from any bank, you should know the BLR Malaysia (Base Lending Rate) and the package offer by the bank.

BLR (Base Lending Rate) is a minimum interest rate calculated by financial institutions based on a certain formula. This formula takes into account the institutions cost of funds and other administrative costs.

The BLR is adjusted by banks, but the rate actually is determined by Bank Negara Malaysia (BNM) during Monetary Policy Meeting.

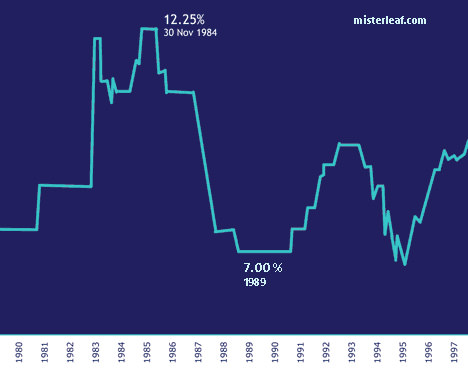

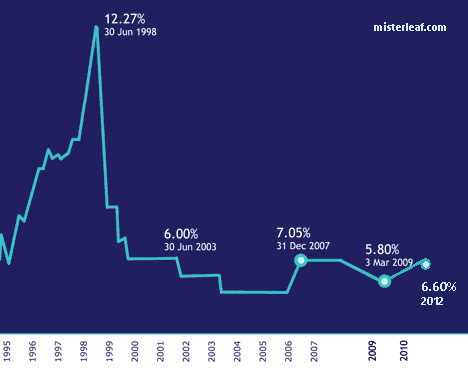

By the way, BLR will change and it is unpredictable whether it will rise or drop. Below is the BLR Malaysia History Chart (1980 – 2014)

| Year | BLR (%) | Remark |

|---|---|---|

| 2014 | 6.85 % | Adjusted on 17 July 2014 |

| 2013 | 6.6 % | |

| 2012 | 6.6 % | |

| 2011 | 6.6 % | Adjusted May 2011 |

| 2010 | 6.3 % | Adjusted July 2010 |

| 2010 | 6.05 % | Adjusted May 2010 |

| 2010 | 5.8 % | Adjusted March 2010 |

| 2009 | 5.55 % | |

| 2008 | 6.75 % | |

| 2007 | 6.75 % | |

| 2006 | 6 % | |

| 2005 | 6 % | |

| 2004 | 6 % | |

| 2003 | 6.5 % | |

| 2002 | 6.5 % | |

| 2001 | 6.75 % | |

| 2000 | 6.75 % | |

| 1999 | 8 % | |

| 1998 | 10.5 % | |

| 1997 | 9.25 % | |

| 1996 | 8.5 % | |

| 1995 | 6.6 % | |

| 1994 | 8.25 % | |

| 1993 | 9.5 % | |

| 1992 | 9 % | |

| 1991 | 7.5 % | |

| 1990 | 7 % | |

| 1989 | 7 % |

How to Get the Best Home Loan Package

blr Malaysia now (2013) is 6.60%, but every bank might offer different package. For example:

Bank A Package

- Bank A offers a package of BLR-1.8% for 30 years. (BLR = 6.6%)

- Means 6.6 % – 1.8 % = 4.8 %.

- If u borrow RM 300,000

- You will be paying about RM 1,574 per month.

Bank B Package

- Bank B offers a package of BLR- 2.0% for 30 years. (BLR = 6.6%)

- Means 6.6 % – 2.0 % = 4.6 %.

- If u borrow RM 300,000

- You will be paying about RM 1,537 per month.

So, when you want to take home loan, please visit more bank to get the best offer from them. Here is a nice video clip “stretching your ringgit”.

Discover more from MisterLeaf.com

Subscribe to get the latest posts to your email.